A Systematic Investment Plan (SIP) is hassle free mode for investing money in mutual funds either Equity or Debt Schemes . It allows you to invest a certain pre-determined amount at a regular interval similar to your old time Piggy Bank which used to inculcate the habit of saving and building wealth for the future.

How does it work?

A SIP is a flexible and easy investment plan. Your money is auto-debited from your bank account and invested into a specific mutual fund scheme on a specified Date .You are allocated certain number of units based on the on going market rate (called NAV ) for the day. Every month your money is invested , additional units of the scheme are purchased at the NAV and added to your account( folio). Hence, units are bought at different rates and investors benefit from Rupee-Cost Averaging and the Power of Compounding.

Rupee-Cost Averaging

With volatile markets, most investors remain unsure about the best time to invest and try to 'time' their entry into the market. Rupee-cost averaging allows you to opt out of the guessing game. Since you are a regular investor your money fetches more units when the price is low and lesser when the price is high. During volatile period, it may allow you to achieve a lower average cost per unit.

Power of Compounding

Albert Einstein once said, "Compound interest is the eighth wonder of the world. He who understands it, earns it... he who doesn't... pays it." The rule for compounding is simple - the sooner you start investing, the more time your money has to grow.

An Example

If you started investing Rs. 10000 a month on your 40th birthday, in 20 years time you would have put aside Rs. 24 lakhs. If that investment grew by an average of sensex returns (for last 35 years), it would be worth Rs. 1.84 Cr when you reach 60. However, if you started investing 10 years earlier, your Rs. 10000 each month would add up to Rs. 36 lakh over 30 years. Assuming the same average annual growth , you would have Rs. 11.62 Cr on your 60th birthday - more than SIX TIMES the amount you would have received if you had started ten years later!

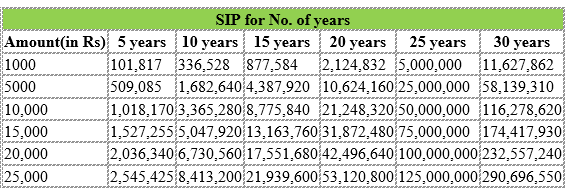

All of us want to RETIRE RICH , below we have attached a table on SIP

* SIP returns of sensex for last 35 years taken for calculations i.e 18%