Debt Mutual Funds are one of the best alternatives of fixed deposits

Both debt fund and fixed deposits falls in the category of debt investments and the return from the debt funds is similar to fixed deposits.

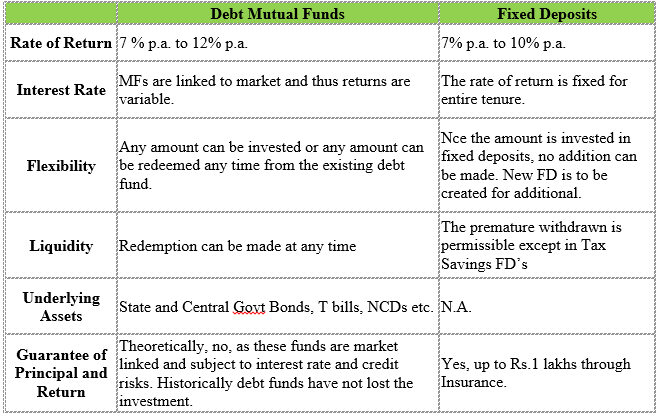

Debt Mutual Funds vs. Fixed Deposits

How Post tax benefits of Debt Mutual Funds beats Fixed Deposits?

Pre-Tax Return of fixed deposits and debt mutual funds are almost similar but post-tax returns have material differences. This is because returns from fixed deposits are taxed as per tax slabs of the investor while returns from debt mutual funds are taxed as capital gains or tax slabs.

If the investment horizon is of less than 3 years, then the return from debt mutual funds are termed as short-term capital gain and taxed as per the slab of investor, similar to fixed deposits but if the investment horizon is of 3 years or more than the actual tax benefit of debt mutual fund can be achieved by combing tax rate with indexation.

The table below gives you the complete understanding of the taxation of debt mutual funds and fixed deposits.

Another tax benefit of opting debt mutual funds over fixed deposits is the deferment of tax. In case of Fixed Deposits, investor has to include the tax in the income every year and pay taxes while in case of debt mutual funds, if no redemption is done, no income is generated therefore no tax becomes payable, this means tax will be payable only when the units of mutual funds are sold.